Irs auto depreciation calculator

Example Calculation Using the Section 179 Calculator. Car Depreciation Calculator.

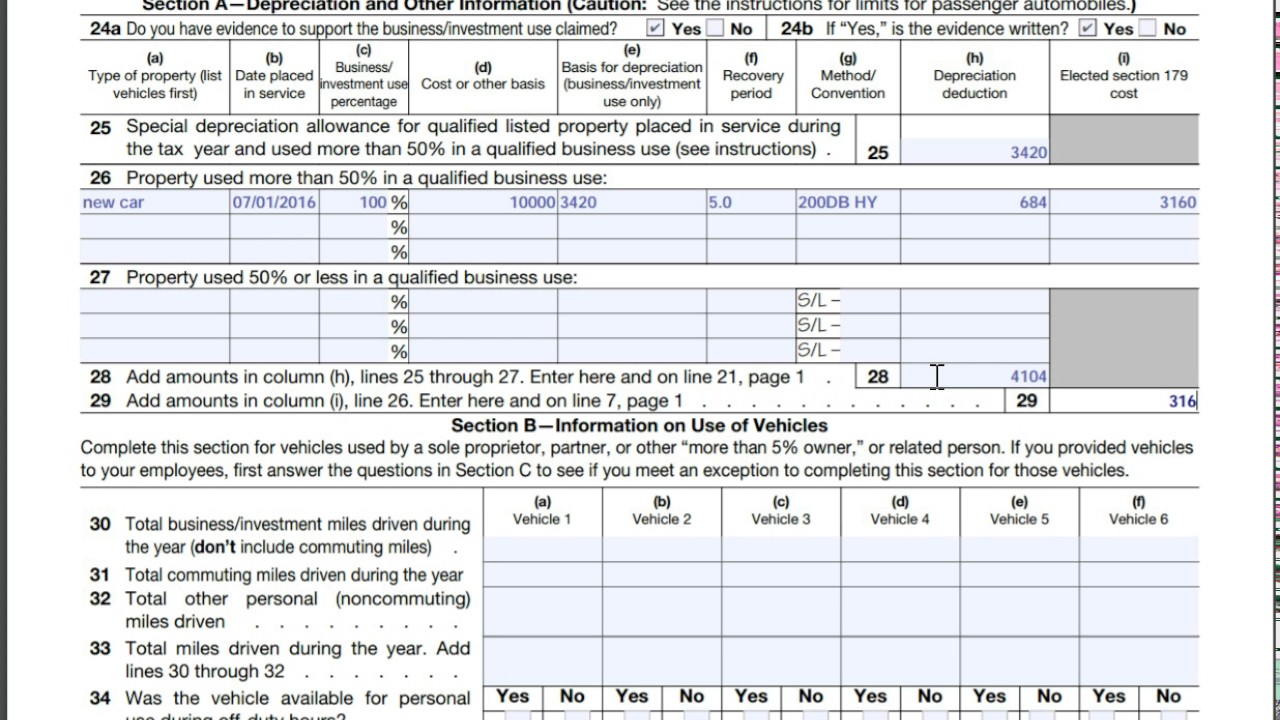

Form 4562 New Car Depreciation Youtube

SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life.

. This calculator will calculate the rate and expense amount for personal or real property for a given. Schedule C Form 1040 Profit or Loss From. Irs Vehicle Depreciation Calculator.

Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. So 11400 5 2280 annually. The MACRS Depreciation Calculator uses the following basic formula.

We base our estimate on the first 3 year. A car 463 Travel Gift and Car Expenses Residential rental property. Depreciation expresses the loss of value over time of fixed assets of.

You can claim business use of an automobile on. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. NW IR-6526 Washington DC 20224. Depreciation deduction limits for passenger automobiles placed.

Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. When its time to file your.

Provide information on the. How to Calculate Depreciation. The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle.

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. We will even custom tailor the results based upon just a few of.

June 27 2021 June 26 2021 by Isabella. Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. 510 Business Use of Car.

The MACRS Depreciation Calculator uses the following basic formula. The purchase would qualify for the 25000 dollar limit Section 179 deduction. Use Form 4562 to.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the. Claim your deduction for depreciation and amortization. It would also be able to deduct bonus depreciation for the first year in the amount of 12500.

Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation. IRS Issues New 2022 Rules for Passenger Car Depreciation The IRS has provided updated tables containing. Make the election under section 179 to expense certain property.

This calculator may be. The recovery periods available is determined by the depreciation method selected. It is determined based on the depreciation system GDS or ADS used.

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. If you use this method you need to figure depreciation for the vehicle.

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting

Depreciation Calculator Depreciation Of An Asset Car Property

Car Depreciation Rates Direct Express Auto Transport

Tax News Depreciation Guru

Section 179 Deduction Hondru Ford Of Manheim

Automobile And Taxi Depreciation Calculation Depreciation Guru

Free Macrs Depreciation Calculator For Excel

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Automobile Depreciation Depreciation Guru

Macrs Depreciation Calculator Irs Publication 946

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Irs Announces Luxury Auto Depreciation Caps And Lease Inclusion Amounts Doeren Mayhew Cpas

Depreciation Of Computer Equipment Computer Equipment Best Computer Computer

Car Depreciation Calculator Nationwide

Automobile And Taxi Depreciation Calculation Depreciation Guru

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax